The Ethena community will decide on a ballot to incorporate Ethereal, a DEX constructed on top of USDe, into Ethena reserve. The idea here is to improve platform liquidity and to integrate the two market types to increase platform efficiency.

Members of the Ethena Labs venture are to decide on whether to implement Ethereal – a decentralized exchange based on the Ethena Network – into the reserve models. This move seeks to increase the “utility and demand” for USDe – a synthetic stablecoin created by Ethena Labs.

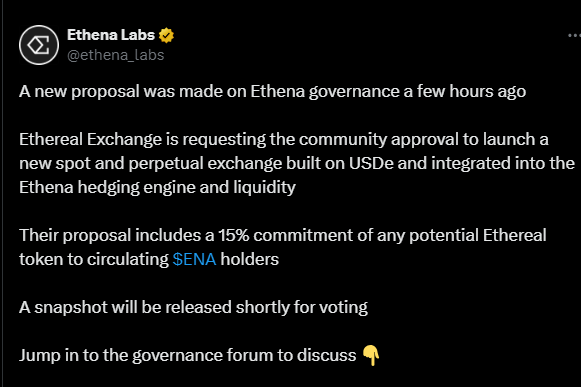

The proposal by “Fells0x on September 30, aims at seeking the authorization of Ethereal to undertake the management of the spot along with the perpetual futures that would harbor USDe. If the proposal will be passed, the current Ethena token holders will be given 15% of any future Ethereal governance tokens.

The V1 of Ethereal, which is planned for testnet release in Q3 or Q4, is expected to deliver centralized exchange level performance with the option for “no, or near to, custodianship” as proposed. Originally, the exchange is built to accomplish 1 million plans per second with the response time of less than 20 ms.

Another advantage listed in the proposal is the future opportunities for applications, such as decentralized lending/borrowing platforms to be developed on the base of USDe.

BlackRock-backed stablecoin UStb, launched recently as an answer to criticisms of USDe’s risks, is developed by Ethena. Being backed up by BlackRock and Securitize, UStb is to offer a more secure solution in case of negative funding rates.

Even such personalities, like Andre Cronje, raised concerns on the stabilities of USDe, Ethena has maintained that there has not been any signs of instabilities within the half year it has been in existence.

Fells0x has now suggested that Ethereal be adopted into Ethena’s hedging mechanisms. Subject to the approval from the Ethena Foundation and the Risk Committee, the intended action will help Ethena become even more secure and offer extra value to its clients

Nice