The AUD/USD rate rises as tax reductions and pleasant climate fuel retail sales

The AUD/USD is now achieving positive pace, besides the AUD/ USD currency pair is eyeing up the long-term down trend line. Record retail sales have lessened speculation on the Reserve Bank of Australia to trim interest rates this year.

Retail Sales Surge

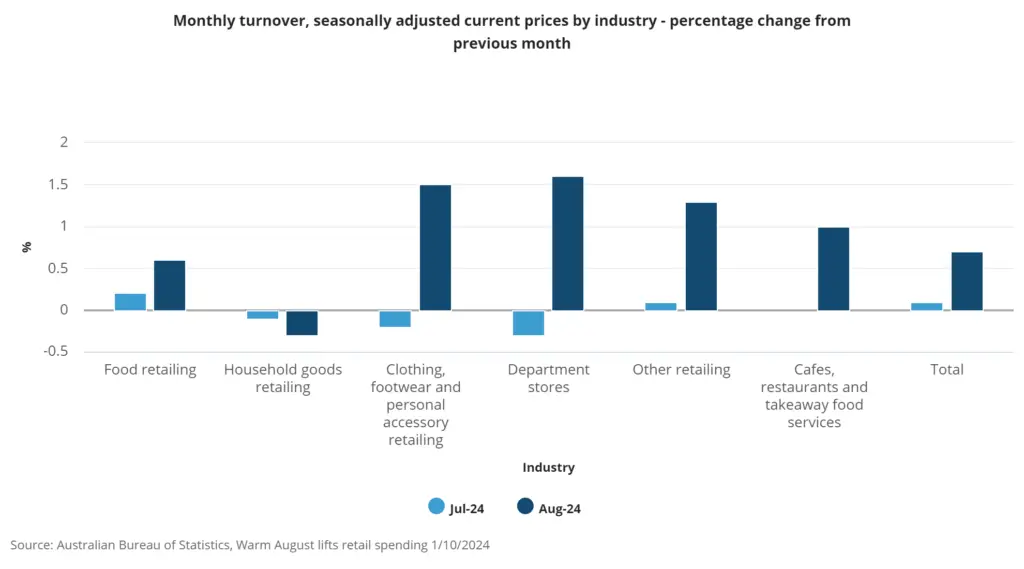

Data from the Australian Bureau of Statistics stated that during August retail turnover was up by 0.7 % a figure that closely mirrored market expectations of 0.4% growth. This raised the yr/yr growth to 3.1% – the highest pace of increase since May last year.

Expenditure increased in almost all accounts excluding household goods. Pioneering the list were the department stores, clothing and footwear and personal accessories, and other retailing. Another core sector that offered resistance was the food retailing Where, spending+”) on cafes, restaurants, and takeaway food services went up by 1.0%.

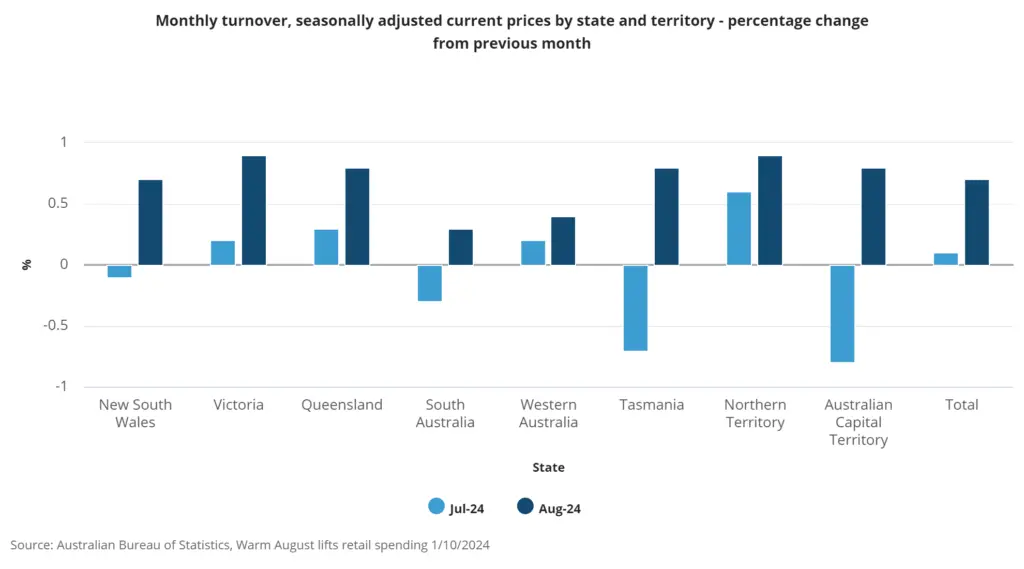

The ABS added that while a good portion of the country experienced warm weather, this may have also helped push up the sunshine numbers. Yet, there is an argument that volatility went up in each state and territory and, therefore, was partially driven by other factors in the macro economy. Also, to encourage spending, saving, or investing the government further reduced income tax starting in July.

Building Approvals Data

Other data released today, including building approvals, fell 6.1% in August after rising at an 11% rate in July, according to the data. Stripping out of apartment approvals which are sometimes erratic, private sector house approvals were up by 0.5%, and up by 8.4% on the year.

Key Day for AUD/USD

After this data releases AUD/USD surged to touch session high in anticipation of a third sequential attempt to break the long-term bearish trend line resistance.

From the Daily Chart the pair is trying to push against this level that is why today is a point of decision due to the presence of uptrend support. An entry above the 0.6940 could offer good long signal for a breakout above the downtrend. This would afford putting a stop below the level with target at the resistance level of 0.7137.

The RSI (14) similar to MACD is still in an upward trend however there is a bearish divergence between RSI and price. This means that without one’s confirmation when a topside breakout signal is certain, it may be wiser not to anticipate for it.

If the uptrend is violated, the same traders may consider going short, below the downtrend towards a move towards the previous resistance around 0.6830.

Fundamental Influences

From a basic point of view, the US JOLTS survey and the ISM manufacturing PMI data are expected to affect the AUD/USD later in the Tuesday. Should these reports come in weaker than expected, then the USD might give grounds across the G10 currency space with extra encouragement to the Australians Dollar.

The articles you write help me a lot and I like the topic

Thanks for posting. I really enjoyed reading it, especially because it addressed my problem. It helped me a lot and I hope it will help others too.